BTC Price Prediction: Bullish Trajectory Intact with $164K Target in Sight

#BTC

- Technical Strength: BTC holds above critical MA with Bollinger Bands suggesting imminent volatility expansion

- Institutional Adoption: Google, Amdax and nation-state actors are accelerating BTC accumulation

- Macro Tailwinds: Halving cycle and ETF approvals create perfect storm for price appreciation

BTC Price Prediction

BTC Technical Analysis: Key Indicators Point to Bullish Momentum

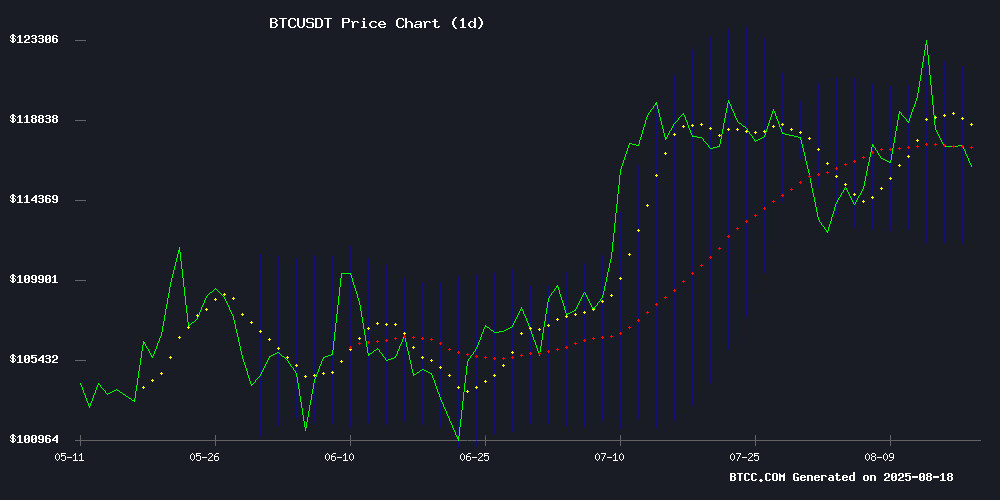

According to BTCC financial analyst Michael, Bitcoin (BTC) is currently trading at 116,941.33 USDT, slightly above its 20-day moving average (MA) of 116,861.41. The MACD indicator shows a bearish crossover but with narrowing divergence, suggesting potential consolidation before another upward move. Bollinger Bands indicate a tight range, with the upper band at 121,753.36 and the lower band at 111,969.46, signaling reduced volatility. Michael notes that BTC is testing key resistance levels, and a breakout above the upper Bollinger Band could confirm a bullish continuation.

Market Sentiment: Institutional Interest and Whale Activity Fuel BTC Optimism

BTCC financial analyst Michael highlights several bullish catalysts for Bitcoin. Thailand's crypto-to-fiat conversions for tourists and Dutch firm Amdax's bitcoin treasury strategy on Euronext Amsterdam demonstrate growing institutional adoption. Google's increased stake in TeraWulf and MicroStrategy's continued BTC accumulation underscore corporate confidence. However, Michael cautions that dormant whale movements and potential mining hardware regulations could introduce short-term volatility. Overall, sentiment remains positive with a $164K price target in sight.

Factors Influencing BTC’s Price

Thailand Launches Crypto-to-Fiat Conversions for Tourists

Thailand is rolling out a new initiative called "TouristDigiPay" on August 18, allowing foreign visitors to convert cryptocurrency into Thai Baht for payments. The move aims to counter a tourism slowdown, exacerbated by declining Chinese visitors and competitive pressures from neighboring markets.

The program operates within a regulatory sandbox, restricting direct crypto payments while advancing Thailand's cashless society goals. Tourists must open a local account with Thai authorities to participate, highlighting the country's cautious yet progressive stance on digital assets.

Bitcoin was initially proposed for a Phuket pilot, but regulatory hurdles persist. The central bank maintains its ban on direct crypto payments, underscoring the delicate balance between innovation and oversight.

Dutch Firm Amdax to Launch Bitcoin Treasury Strategy on Euronext Amsterdam

Amsterdam-based cryptocurrency platform Amdax announced plans to introduce a Bitcoin treasury product, AMBTS, on the Dutch stock exchange Euronext. The initiative positions Amdax as a regional pioneer in institutional Bitcoin adoption, leveraging its five-year operational history and regulatory credentials.

The Amsterdam bitcoin Treasury Strategy will operate as a standalone entity under a private limited liability structure. Amdax CEO Lucas Wensing cited corporate Bitcoin holdings exceeding 10% of total supply as validation for the timing of this listed product.

As a fully licensed entity registered with both the Dutch Central Bank and the Authority for the Financial Markets, Amdax brings established compliance frameworks to this institutional-grade offering. The launch occurs amid Bitcoin's ongoing price volatility, which has yet to recover from recent market downturns.

TeraWulf Shares Surge as Google Increases Stake to 14% in Bitcoin Miner

TeraWulf's stock climbed 5% following Alphabet-owned Google's decision to raise its stake in the bitcoin mining firm to 14%. The tech giant is providing a $3.2 billion financial backstop, enabling TeraWulf to expand its New York data center campus through debt financing. In return, Google secured warrants for over 73 million shares.

The deal, initially disclosed in TeraWulf's Q2 earnings, saw Google revise its commitment upward from $1.8 billion after cloud provider Fluidstack expanded its lease agreement. CEO Paul Prager characterized the partnership as a significant endorsement from a leading AI innovator.

The Lake Mariner facility, poised to become one of America's largest data centers, coincides with TeraWulf's $400 million debt offering. This MOVE reflects a broader industry trend of bitcoin miners pivoting toward AI infrastructure, with the data center market projected to reach $585 billion by 2032.

Dormant Bitcoin Whales Resurface, Sparking Market Caution

Bitcoin's market stability faces a fresh test as long-dormant whale wallets awaken. Analysts track two significant movements: a $3.78 billion transfer from wallets inactive since 2020-2022, and a separate $353 million transaction from a five-year-old wallet holding $2.82 billion in BTC. These movements historically precede major price inflection points.

The timing coincides with Bitcoin's attempted recovery from a pullback after reaching $124,000. Market observers note similar whale activity in March 2024 preceded a 30% price decline. "These transfers often mark pivotal moments—either local tops or bottoms," says CryptoQuant analyst Maartunn.

Bitcoin's Bullish Trajectory Holds Firm with $164K Target in Sight

Bitcoin's upward momentum remains unbroken, with analysts reaffirming a $164,000 price target. The cryptocurrency, which has been on a bullish trajectory since late 2022, continues to trade within an uptrend channel. This Optimism stems from a mid-September 2023 forecast when BTC was priced around $26,000, predicting a surge to $100,000-$200,000 by late 2025.

The latest all-time high of $124,532 on August 14 underscores this bullish narrative. Fibonacci extensions suggest a potential rally to $164,000-$216,000, with more than three months remaining in the current cycle. A long-term trading alert service triggered a buy signal at $28,476 in March 2023, and no sell signal has emerged since—mirroring patterns seen in previous cycles.

Elliott Wave theory and cyclical analysis further support the sustained uptrend. Bitcoin's resilience since its 2022 lows reinforces confidence in its four-phase market cycle, currently positioned in the 'Mid Bull' stage. The absence of distribution patterns or trend reversals suggests the rally has room to run.

Amdax Launches Bitcoin Treasury Ambitioning 1% of BTC Supply, Eyes Euronext Listing

Amsterdam-based crypto service provider Amdax has unveiled AMBTS B.V., a new Bitcoin treasury company with plans to list on Euronext Amsterdam. The firm aims to accumulate 1% of Bitcoin's total supply, positioning itself among the largest institutional holders globally.

The initiative reflects growing institutional demand for Bitcoin as a hedge against inflation and macroeconomic uncertainty. Europe's push for digital asset infrastructure seeks to rival corporate adoption seen in the U.S. and Asia.

Amdax, registered with the Dutch Central Bank since 2020, recently secured approval under Europe's MiCA framework. The move signals regulatory progress as Bitcoin gains traction among institutional investors.

Bitcoin Miner TeraWulf Announces $400M Private Notes Offering for Data Center Expansion

TeraWulf Inc., a prominent Bitcoin mining company, revealed plans to raise $400 million through a private offering of convertible senior notes due in 2031. The offering, targeting qualified institutional buyers, includes an option for an additional $60 million within 13 days of issuance. Proceeds will fund data center expansion and other corporate initiatives, with a portion allocated to capped call transactions.

The convertible notes, structured as senior unsecured obligations, will accrue semi-annual interest payments starting March 2026. This move aligns with industry trends where capital-intensive operations leverage convertible instruments to secure financing while delaying shareholder dilution. TeraWulf's strategic push into high-performance computing infrastructure underscores the sector's growing diversification into AI and cloud workloads.

Bitcoin Market Equilibrium Signals Consolidation as Price Tests Key Levels

Bitcoin's market structure suggests a rare equilibrium between short-term traders and long-term holders, with the $120,000 level emerging as a critical battleground. The cryptocurrency faces mounting selling pressure after failing to sustain cycle highs, prompting traders to watch range boundaries between $120K resistance and lower supports.

Analysts note that breakdowns from such consolidation phases historically precede volatility spikes. Axel Adler's HODL Structure analysis reveals stagnating flows between young and old coins—a telltale sign of market indecision. Short-term holders appear reluctant to rotate positions while long-term investors maintain their stakes, creating unusual stability in realized capitalization metrics.

$30M Scheme to Secure Trump Pardon for Bitcoin Pioneer Roger Ver Collapses

A brazen attempt to broker a presidential pardon for cryptocurrency figure Roger Ver unraveled after operatives failed to deliver on promises of White House access. The plot, hatched over lobster in Puerto Rico, targeted the Bitcoin Cash advocate known as 'Bitcoin Jesus' while he faced tax evasion charges tied to $240 million in token sales.

Florida supplement salesman Matt Argall—now self-styled as 'Lord Argall'—partnered with former child actor Brock Pierce to pitch a $30 million clemency package. Communications reveal Argall demanded $10 million upfront, with $20 million contingent on pardon approval, framing it as a 'success fee' for his alleged political connections.

The scheme capitalized on Ver's 2014 expatriation to Saint Kitts and Nevis following his IRS indictment. Argall claimed access through TRUMP campaign veteran Robert Wasinger, who previously facilitated Elliott Broidy's pardon. White House officials disavowed any knowledge of the arrangement.

Samson Mow Proposes Mining Hardware Ban to Combat Bitcoin Spam Transactions

Bitcoin's scaling debate intensifies as industry leaders grapple with a surge in network spam. Jan3 CEO Samson Mow has floated a controversial solution: mining hardware manufacturers should restrict sales to firms processing non-financial transactions.

Mow's proposal, amplified via social media, suggests Block's Proto Mining division could impose sales restrictions or premium pricing on public miners like Marathon Digital. The theory posits that a 2% economic penalty WOULD outweigh the marginal profits from spam transactions.

The idea has garnered support from Bitcoin maximalists, though Block's stance remains unclear. This development marks the latest chapter in Bitcoin's ongoing struggle to balance network utility with transaction efficiency.

MicroStrategy Continues Bitcoin Accumulation Amid Potential Stock Sales for Debt Obligations

MicroStrategy, the corporate leader in Bitcoin treasury acquisitions, has purchased an additional 430 BTC for approximately $51.4 million, bringing its total holdings to 629,376 BTC. The firm's average purchase price stands at $73,320 per Bitcoin, with a year-to-date yield of 25.1% as of August 2025.

CEO Michael Saylor's announcement comes amid a broader market pullback, with corporate Bitcoin holdings declining by 2,000 BTC since early August. While Japanese firms have recently outpaced MicroStrategy's purchases, the company remains a dominant force in institutional accumulation.

The strategy shift raising eyebrows involves potential stock sales to meet debt obligations rather than fund further Bitcoin purchases. This pivot marks a departure from MicroStrategy's established pattern of leveraging equity markets to finance its crypto acquisitions, sparking concerns about possible contraction in its aggressive accumulation strategy.

BTC Price Predictions: 2025, 2030, 2035, 2040 Forecasts

| Year | Conservative Target | Bullish Target | Key Drivers |

|---|---|---|---|

| 2025 | $140K | $164K | ETF inflows, halving effects |

| 2030 | $250K | $500K | Global reserve asset status |

| 2035 | $750K | $1.2M | Institutional dominance |

| 2040 | $1.5M | $3M+ | Scarcity premium |

Michael projects Bitcoin could reach $164K by end-2025 based on current technicals and institutional demand. Long-term, he sees exponential growth as BTC becomes a global monetary standard, with 2030 targets reflecting increased scarcity post-2028 halving. By 2040, Michael believes BTC's fixed supply could drive valuations exceeding $3M per coin as adoption reaches saturation.